Wie hoch ist die monatliche Rate für ein Mobilheim? Kosten aufdecken

Are you considering buying a mobile home but unsure about the monthly payment? Understanding the costs involved is crucial for budgeting and making informed decisions.

You might wonder if a mobile home is the right choice for your financial situation. This article will break down the factors that influence mobile home monthly payments, giving you a clear picture of what to expect. By the end, you’ll have the insights needed to determine if a mobile home fits your lifestyle and budget.

Dive in to discover how a mobile home could be a smart, affordable step towards homeownership.

Factors Influencing Mobile Home Costs

Location affects mobile home cost. Cities have higher prices. Rural areas cost less. Land prices vary by location. Climate matters too. Cold areas may need extra heating. Warm areas might need more cooling. Safety also matters. Safe places cost more. Check local laws. They affect costs.

Mobile homes come in different sizes. Single-wide homes are cheaper. Double-wide homes cost more. Bigger homes have more space. They cost more money. Models vary too. Luxury models are pricier. Basic models are cheaper. Choose what fits your budget. Think about space you need. And features you want.

New homes cost more. They have latest features. Used homes are cheaper. They may need Reparaturen. New homes have better warranties. Used homes may not. Consider your budget. Decide what you can afford. Think about maintenance costs. New homes have less wear. Used homes may need more work.

Finanzierungsmöglichkeiten

Bank loans can help buy a mobile home. Interest rates are often lower. Loan terms are usually long. This means smaller monthly payments. You may need a gute Kreditwürdigkeit. A down payment is also important. Banks want to feel safe when lending money.

Personal loans are another choice. These loans are often unsecured. This means no collateral is needed. Interest rates can be higher. Monthly payments might be more. Approval is often quicker. You can use the money for anything. Not just a mobile home.

Manufacturers may offer financing too. This can be simple. They know the homes well. Sometimes the Zinssätze are good. They may have deals and discounts. Quick approval is a bonus. It’s easy to get started. You might buy from them directly.

Interest Rates And Terms

Interest rates can be fixed or variable. Fixed rates stay the same. They are predictable and stable. Variable rates change over time. They can be risky. But sometimes they start lower than fixed rates.

Fixed Vs. Variable Rates

Choosing fixed rates means you pay the same every month. It’s safe and easy to plan. Variable rates can go up or down. You might pay less or more.

Loan Term Length

Loan term length affects monthly payments. Shorter terms have higher payments. Longer terms have lower payments. Long terms mean more interest over time. Short terms save money on interest.

Down Payment Requirements

Buying a mobile home needs a down payment. This is usually 5% to 20% of the total price. A bigger down payment means a smaller loan. This can make monthly payments lower. Banks might ask for more if your credit is not strong. Always check what your bank needs.

Monthly payments depend on the down payment. Higher down payments can lead to smaller monthly costs. This makes it easier to pay each month. Smaller down payments might mean bigger monthly costs. It’s important to plan well. Think about your budget. Decide what works best for you.

Additional Costs

Mobile home monthly payments often include hidden expenses. Insurance, property taxes, and maintenance add to the basic cost. Be prepared for these additional fees.

Versicherung

Insurance protects your home from damage. Mobile home insurance may cost less than regular home insurance. The price depends on the home’s size and location. Always check what the policy covers. Some policies include fire and theft protection. Others may not.

Property Taxes

Property taxes vary by location. They can be high or low. Check your local tax rules. Some areas charge more for land. Others focus on the home’s value. Always budget for these taxes.

Maintenance And Repairs

Maintenance and repairs keep your home safe. Set aside money for small fixes. A leaky roof or broken window costs money. Regular checks can prevent big issues. Keep your home in good shape. This saves money in the long run.

Budgeting For A Mobile Home

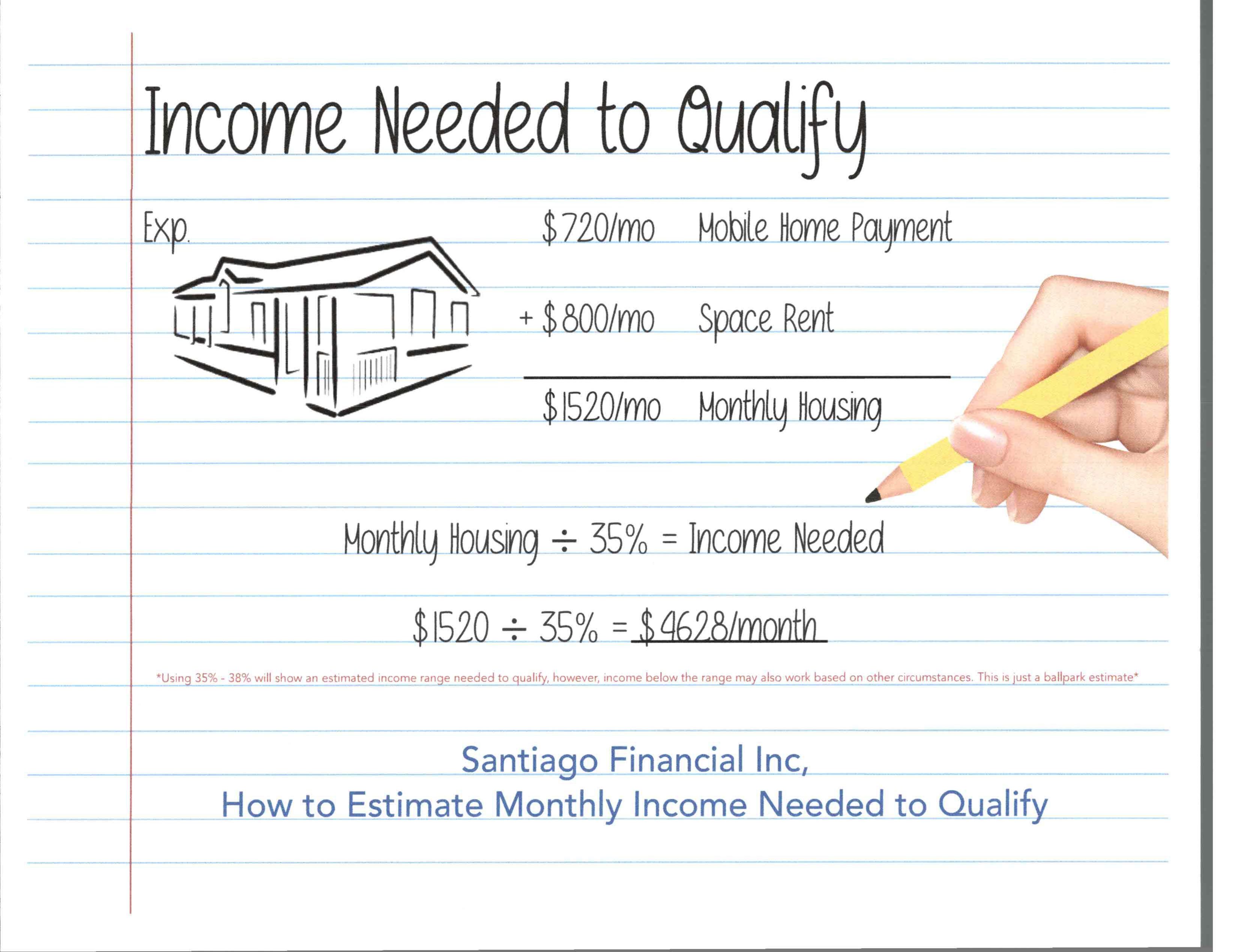

Mobile home payments can vary widely. Prices depend on the home’s size Und location. A typical mobile home payment might range from $200 to $700 each month. This estimate excludes other costs. Taxes Und Versicherung add to monthly expenses. It’s important to account for Stromrechnungen too. These can be significant, especially in extreme weather conditions.

Start with the monthly payment. Then add taxes, Versicherung, Und utilities. Factor in maintenance costs. Mobile homes need regular upkeep. Allocate funds for unexpected repairs. Consider community fees if the home is in a park. These fees cover shared spaces and services. Keeping track of each cost helps manage finances better.

Tips For Reducing Costs

Verhandlung can help lower your mobile home payment. Ask for a better deal. Speak to the seller. Discuss what you can afford. Point out any issues with the home. Use these to get a better price. Prepare for the talk. Know what you want. Stay polite but firm.

Discounts can reduce costs. Look for seasonal offers. Überprüfen for promotions. Inquire about any available incentives. Manchmal there are special deals. Ask if you qualify for any. Understand the terms well. Read the fine print. Make sure discounts work for you.

Häufig gestellte Fragen

What Factors Influence Mobile Home Monthly Payments?

Several factors influence mobile home monthly payments. These include the home’s price, interest rates, loan term, and down payment. Additionally, the buyer’s credit score and location can impact the payment amount. Property taxes, insurance, and maintenance fees also contribute to the overall monthly cost.

How Can I Lower My Mobile Home Payments?

To lower mobile home payments, consider increasing your down payment or choosing a longer loan term. Refinancing at a lower interest rate can also help. Improving your credit score before applying for a loan may reduce interest rates. Additionally, compare different lenders to find the best deal.

Are Mobile Home Loans Different From Traditional Mortgages?

Yes, mobile home loans differ from traditional mortgages. Mobile homes may be financed as personal property with a chattel loan. These loans often have higher interest rates and shorter terms. Traditional mortgages generally apply to real estate, which can offer longer terms and potentially lower rates.

Is Insurance Included In Mobile Home Payments?

Insurance is typically not included in mobile home payments. Buyers must purchase separate insurance for their mobile home. Insurance costs vary based on the home’s value, location, and coverage level. Some lenders may require proof of insurance to approve the loan, adding to the overall monthly cost.

Abschluss

Understanding mobile home payments is essential. Costs can vary greatly. Factors like location, size, and loan terms influence monthly payments. Research and planning help manage these costs effectively. Consider all expenses, including utilities and maintenance. This ensures a realistic budget.

Compare different financing options. Consult with experts if needed. This aids in making informed decisions. A clear budget reduces financial stress. Owning a mobile home offers flexibility and affordability. With careful planning, it can be a rewarding investment. Explore your options.

Make informed choices. Enjoy your new home journey!