What is Payment in Lieu: Discover Its Impact

Imagine you’re about to leave your current job for an exciting new opportunity. You’ve got one foot out the door, but there’s a question hovering in your mind: what happens to your unused vacation days?

Enter the concept of “payment in lieu. ” This term might sound a bit technical, but it’s all about ensuring you get what you’ve earned before you transition to your next chapter. Understanding payment in lieu could mean cash in your pocket instead of time off left on the table.

Curious to know how it works and what it could mean for your future paychecks? Stick around, because this article will break it down in a way that’s simple and relevant to your life. We promise to shed light on this aspect of employment, potentially boosting your financial wellness. Are you ready to unlock the mystery behind payment in lieu and discover how it could benefit you? Keep reading to find out!

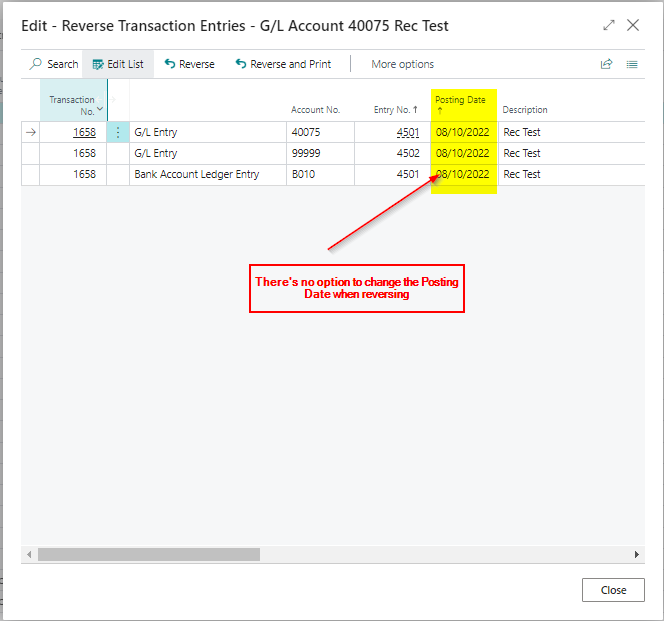

Payment In Lieu Defined

Payment in Lieu means receiving money instead of something else. Employers give this payment to employees instead of them working notice periods. It is a common practice. This Zahlung covers the time you would have worked. You get paid for that time without working. Payment in Lieu is a financial arrangement. It ensures employees are compensated for their notice period. Employees appreciate this option. It lets them move quickly to new jobs. This payment is also called PILON. It stands for Payment in Lieu of Notice.

Employers save time with PILON. They don’t wait for notice periods to end. Employees leave sooner. This payment can be a win-win. It is not always offered by all companies. Contracts may have details on PILON. Always check your contract for such terms. Verständnis payment in lieu helps in job transitions. Knowing your rights is important.

Historical Context

Payment in lieu has a long history. Long ago, workers were paid in different ways. In some places, they got Geld instead of time off. This was known as payment in lieu. It helped workers meet needs quickly. They could use the money for food or other things. This method was popular in many countries. Laws were made to protect workers’ rights. They made sure workers were treated fairly. Some workers liked this option. It gave them more choices. They could decide what was best for them. Over time, many employers started using this method. It became a common practice.

Legal Framework

Payment in lieu is money given instead of notice. It’s important in jobs. Laws about this vary. Some countries have strict rules. Employers must follow these laws. They must know employee rights. Sometimes, payment in lieu is in a contract. Other times, it’s agreed later. Understanding these laws helps both bosses and workers.

Contracts often include payment in lieu terms. Employers should check contracts carefully. If it’s in the contract, it’s a must. Both parties should agree on terms. This helps avoid disputes later. Clear contracts make things simple. They help everyone understand their duties. Ensuring clarity protects both sides.

Reasons For Payment In Lieu

Employers might choose payment in lieu for several reasons. It helps end contracts quickly. This can save on costs and time. A sudden closure or change in business direction can require this. Employers may need to reduce staff numbers. They might want to avoid legal complications. Paying instead of notice can prevent disruptions in work. It helps in maintaining a smooth workflow. Employers often find it practical and efficient.

From the employee’s side, payment in lieu offers immediate financial support. It provides a lump sum payment. This can be helpful if seeking new jobs. Employees can plan their future without waiting. They get money right away instead of waiting for notice periods. This can help meet urgent needs or support career changes. Payment in lieu can also reduce stress and uncertainty.

Impact On Employers

Payment in lieu can affect business costs. Employers must pay workers for not working. This can increase expenses. The company must budget carefully. Unplanned costs can affect profits. Money saved for other things might be used here. It’s important to plan ahead.

Payment in lieu affects day-to-day work. Fewer workers might mean more work for others. It can lead to stress and lower performance. Managers need to plan tasks well. Schedules might need changes to cover gaps. Good planning ensures smooth operations. It’s vital for success.

Impact On Employees

Payment in lieu offers quick money to workers. It helps them manage bills. Workers receive money without waiting for paychecks. This money can be helpful in tough times. It eases stress about money problems. The extra money can support family needs. Workers can plan better with this money. It gives them freedom to spend or save. They have choices on how to use it. This money can help in buying essentials. It can also be used for emergencies. Workers feel secure with extra funds. The financial boost is a relief.

Changing jobs can be hard. Workers face new Herausforderungen. Payment in lieu helps during job changes. It supports while searching for new work. Workers might feel stressed about new roles. New job skills might be needed. Learning new duties can be confusing. Payment in lieu eases some worries. It provides support during tough changes. Workers need time to adjust. They might miss old coworkers. Understanding new tasks takes patience. The transition can be smoother with help. Payment in lieu offers a safety net.

Steuerliche Auswirkungen

Payment in lieu refers to compensation given instead of something else, like unused vacation days. Tax implications can vary. This payment is usually considered taxable income, affecting how much tax you owe. Understanding this can help in financial planning.

Employer Tax Obligations

Employers must handle taxes correctly for payment in lieu. This payment is steuerpflichtig and must be reported. Employers should deduct Einkommensteuer Und national insurance. It’s important to follow the local tax rules. Failure to comply may lead to penalties. Employers should keep genaue Aufzeichnungen of payments. This ensures transparency and avoids legal issues.

Employee Tax Considerations

Employees receiving payment in lieu need to understand tax effects. These payments are subject to tax. Employees must report them in their Steuererklärungen. Some payments may be tax-free, but conditions apply. Employees should consult tax advisors for guidance. Accurate reporting helps avoid unexpected tax bills. Keeping track of received payments is crucial.

Comparing To Other Severance Options

Payment in lieu is a way to end a job. It means you get paid instead of working your notice period. This option offers quick financial relief. You receive money right away. Other severance options might include a lump sum or continued pay. These can take time to receive.

Some companies offer extra benefits with severance. These might include health insurance or job training. Payment in lieu usually doesn’t include these. It’s a simple, fast payment. Think of it like a quick goodbye gift. Both options help after leaving a job. Payment in lieu is just faster.

Case Studies

Payment in lieu allows employees to receive compensation instead of taking leave. This option is often used when employees prefer immediate financial benefit over vacation time. Case studies demonstrate how businesses manage this arrangement to maintain workforce efficiency.

Real-world Examples

Many companies use payment in lieu to solve problems. One example is a factory closing. The workers get money instead of notice. This helps them quickly find new jobs. Another example is a school teacher. She chose payment in lieu over working a notice period. She needed to move to a different city. This payment helped her move faster.

Lessons Learned

Workers learn the importance of Finanzplanung. Payment in lieu gives them time and money. They can plan for new job opportunities. Companies learn to handle employee transitions smoothly. They avoid tension and confusion during closures. Payment in lieu helps both parties. It ensures a clean break. Planning and communication are key. This makes the process easier.

Future Trends

Evolving employment practices are changing how people work. Many companies are trying new ways to keep workers happy. They offer more flexible hours. Some let people work from home. This makes workers feel valued. It also helps them balance life and work better. Payment in lieu is a part of these changes. It gives workers money instead of time off. This can be good for workers who need extra cash. It also helps those who can’t take time off.

Potential Legal Changes

Legal rules might change soon. Governments look at how payment in lieu works. They want to make sure it is fair for everyone. New laws could make companies follow stricter rules. This ensures workers get what they deserve. These changes aim to protect workers’ rights. Fair payment and time off are important. They help workers have a better life.

Häufig gestellte Fragen

What Is Payment In Lieu?

Payment in Lieu, often called PIL, is a financial compensation. It’s given instead of a certain benefit or obligation. Commonly, employers offer it in place of notice periods. This allows employees to leave a job immediately. It ensures a smoother transition for both parties involved.

Why Do Companies Offer Payment In Lieu?

Companies offer Payment in Lieu to expedite employment transitions. It allows employers to terminate contracts without notice. This payment compensates for the employee’s notice period. It also helps businesses manage workforce changes more efficiently. This option provides flexibility for both the employer and the employee.

How Is Payment In Lieu Calculated?

Payment in Lieu is calculated based on the employee’s salary. It often includes benefits and bonuses. The calculation considers the duration of the notice period. Employers ensure fair compensation aligning with employment contracts. It’s essential for the amount to reflect the full value of the notice period.

Is Payment In Lieu Taxable?

Yes, Payment in Lieu is usually taxable. It is considered part of the employee’s earnings. The taxation depends on the local tax laws and regulations. Employers often deduct taxes before making the payment. Consulting a tax professional can provide clarity on specific tax obligations.

Abschluss

Payment in lieu offers flexibility in employment transitions. It allows employees to leave jobs sooner. This can be beneficial for both parties. For employers, it simplifies administrative processes. Employees receive compensation without serving notice. Understanding this concept helps in making informed decisions.

Always check specific terms in employment contracts. Knowing your rights and options is crucial. It ensures a smooth transition in your career. So, whether you’re an employer or an employee, grasping payment in lieu can be helpful. It aids in managing professional changes effectively.

Keep this information handy for future reference.