Wie funktioniert eine virtuelle Visa-Karte: Entfesseln Sie digitalen Komfort

Imagine having all the benefits of a traditional credit card without the hassle of carrying it around. That’s the magic of a virtual Visa card.

You might wonder how this innovative tool fits into your everyday financial transactions. It’s simple, secure, and incredibly convenient. You can shop online, pay bills, and even subscribe to services with just a few clicks, all while keeping your personal information safe.

Ready to dive into the world of virtual Visa cards and see how they can transform your spending habits? Let’s unravel how they work and why they might be your new favorite financial tool.

What Is A Virtual Visa Card

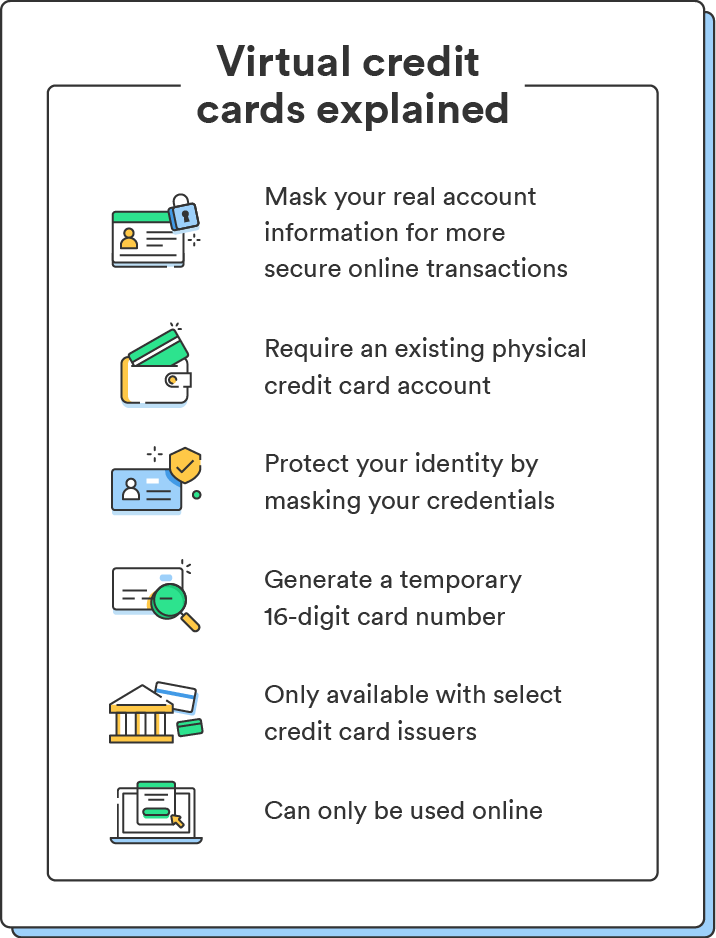

A Virtuelle Visa-Karte is like a regular card but digital. You don’t need a physical card to use it. You can shop online with it easily. It has a card number, expiration date, and security code. These details let you pay online safely. It helps keep your real card details private. You can use it for one-time payments. Or for many payments over time. Some people use it for subscriptions. It is quick to set up. You can usually get it through your bank. Or through an app. It is safe and convenient. Many people find it useful. It is a smart way to shop online.

Hauptmerkmale

Digital Format makes virtual Visa cards easy to use. You can access them on your phone or computer. No need to carry a physical card. You get all card details through email. It’s safe and secure.

Sofortige Ausstellung means you get your card right away. No waiting for mail delivery. You can start using it as soon as you receive it. Perfect for online shopping. Get instant access to funds.

Global Acceptance lets you use your card anywhere. Most online stores accept virtual Visa cards. Great for international shopping. Travel without worries. Spend easily in different currencies.

How To Obtain A Virtual Visa Card

Visit your bank’s website. Look for the virtuelle Karte option. Fill out a simple form. Your bank may ask for persönliche Daten. They might need your account number too. Once approved, you get a card online. Use this card for safe online shopping. It has a unique number and expiry date.

Platforms like PayPal offer virtual cards. Sign in to your account first. Choose the virtual card option. Fill in your details. The platform provides a card number. Use this number for online purchases. It’s easy and sicher. No need for a physical card.

Services like Revolut offer virtual cards. Download their app. Create an account with them. They require basic information. You can get a card instantly. Use it for Online-Transaktionen. These cards are simple and fast to use.

Activation Process

A virtual Visa card arrives through email. Überprüfen Sie Ihre E-Mails for the card details. It includes a card number, expiration date, and CVV code. Save these details for later use. Usually, there’s no physical card. It’s all digital.

Create a username and password. Choose strong passwords for security. You might need to answer security questions. Keep answers safe and memorable. This helps protect your card from misuse.

You can connect your virtual card to online accounts. Add card details in payment settings. This makes online shopping easy. Ensure accounts are secure. Check for secure websites before entering card info.

Using A Virtual Visa Card

A virtuelle Visa-Karte makes shopping online easy. Enter your card number and expiration date. This keeps your real details safe. You don’t need a physical card. It works just like a normal card. Most websites accept it. It’s fast and secure.

Virtual Visa cards are great for subscriptions. Use them for monthly or yearly payments. You can manage your spending better. Cancel anytime without hassle. Avoid unwanted charges. Many services like Netflix and Spotify accept them.

Add your virtual Visa card to a mobile wallet. Use apps like Apple Pay or Google Pay. Tap your phone to pay in stores. It’s easy and quick. No need for cash or cards. Secure payments with just your phone. It’s convenient and saves time.

Sicherheitsmaßnahmen

Virtual Visa cards offer strong Betrugsschutz. They are safer than regular cards. Each card has a unique number. This number changes often. It makes it hard for thieves to steal. If someone tries to use it wrongly, the card stops working. Banks watch for strange actions. They keep your money safe.

Verschlüsselungstechnologie protects your data. It scrambles your information. Only you and the bank can read it. This keeps your details private. Hackers can’t see your card number. Your online purchases are secure. It is like locking your data in a safe.

Virtual cards use temporary card numbers. These numbers last for a short time. They are used once. After buying, they disappear. This prevents theft. Even if stolen, the card number won’t work again. It adds extra safety. Your real card number stays hidden.

Benefits Of Virtual Visa Cards

Virtual Visa cards are easy to use. You can shop online without any hassle. No need to carry a physical card. Get instant access to your funds. Manage your card from your phone or computer. Quick and simple transactions are possible.

Your money stays safe with virtual cards. No risk of losing a card. Virtual cards are hard to steal. They offer extra layers of protection. You can set spending limits to prevent theft. Secure online shopping becomes easy.

Keep track of your spending. Set limits on your virtual card. Control expenses with ease. Virtual cards help you save money. No overspending worries. Easy monitoring of transactions is possible. Stick to your budget effortlessly.

Potential Drawbacks

Virtual Visa cards can’t be used in physical stores. They are only for online shopping. No swiping or inserting into card machines. Not handy for buying groceries or clothes. Always check if the store accepts virtual cards. Some stores may not accept them. It’s important to know before shopping.

Virtual Visa cards have Ablaufdaten. They do not last forever. The card stops working after this date. Remember to check the expiration date often. Use the card before it expires. Keep track of when you got the card. This helps you use it in time.

Some virtual cards may have Gebühren. These fees can be for activation or usage. Not all cards have fees. Always read the terms before getting a card. Knowing the fees helps in planning better. Being aware saves money and avoids surprises.

Future Of Virtual Visa Cards

Virtual Visa cards are digital payment tools that offer secure transactions online. They work by generating a unique card number for each purchase, keeping your actual card details safe. These cards are convenient for online shopping and subscriptions, providing an extra layer of protection against fraud.

Technologische Fortschritte

Virtual Visa cards are improving with technology. Safety is getting better. It’s easier to protect your money online. New features make virtual cards more reliable. Smart devices can use virtual cards easily now. These cards can work with apps. This makes payments faster and safer.

Increased Adoption

More people are using virtual Visa cards now. They like the Bequemlichkeit Und Sicherheit. Many stores accept virtual cards. It’s easy to pay online. Virtual cards are popular for shopping. Businesses are starting to use them too. They help manage money better.

Integration With Digital Ecosystems

Virtual Visa cards are part of digital systems. They work with Online-Plattformen. You can link them to apps. This makes shopping easy. Digital wallets use virtual cards too. They help keep track of spending. Virtual cards are part of the digital future.

Häufig gestellte Fragen

What Is A Virtual Visa Card?

A virtual Visa card is a digital payment card used online. It functions like a physical card but exists only electronically. You can make secure purchases online without sharing your actual card details, enhancing privacy and security.

How Do I Get A Virtual Visa Card?

You can obtain a virtual Visa card from your bank or a payment service provider. Many financial institutions offer them via their apps. Simply apply online, and you’ll receive your card details electronically.

Can I Use A Virtual Visa Card Worldwide?

Yes, you can use a virtual Visa card globally wherever Visa is accepted. It’s ideal for international online shopping. Ensure the merchant supports Visa transactions to use your virtual card without any issues.

Is A Virtual Visa Card Secure?

A virtual Visa card is secure for online transactions. It uses encryption and tokenization to protect your information. Since it’s digital, there’s less risk of physical theft or loss compared to traditional cards.

Abschluss

Virtual Visa cards offer a simple, secure payment method. They protect your personal information. No physical card means fewer security risks. Easy to use for online shopping. Many people find them convenient. You can track spending easily. Perfect for budget management.

Widely accepted at many online stores. Setting up a virtual card is quick. You gain control over your finances. It’s a smart choice for online purchases. Consider trying a virtual Visa card today. Enhance your online shopping experience. Stay safe and enjoy the benefits.

A modern solution for modern needs.