API-Geldtransfer auf Bankkonto: Mühelose Lösungen

Imagine having the power to move your money with just a few clicks, seamlessly and securely. That’s the magic of using an API to transfer money to a bank account.

As you dive into this article, you’ll uncover how this technology can revolutionize the way you manage your finances. It’s not just about convenience; it’s about taking control and enhancing your financial freedom. Curious about how it all works and how it can benefit you personally?

Stay with us, and by the end, you’ll be ready to harness this tool to make your financial transactions smoother and more efficient than ever before.

Api Basics

APIs are essential tools in modern technology. They enable different software systems to interact seamlessly. In money transfer, APIs are crucial. They connect payment platforms with banks. They ensure transactions are smooth and efficient.

Definition And Functionality

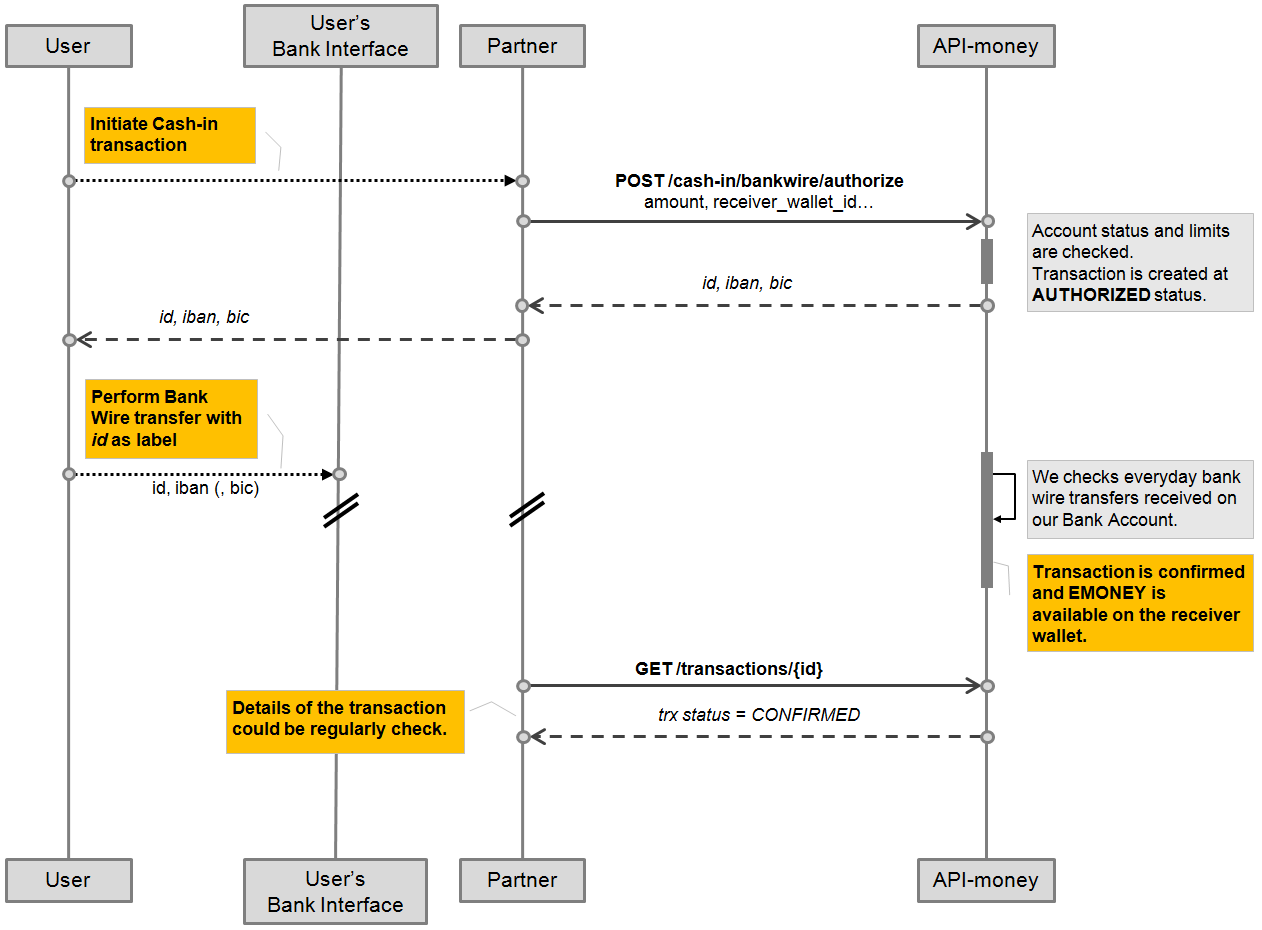

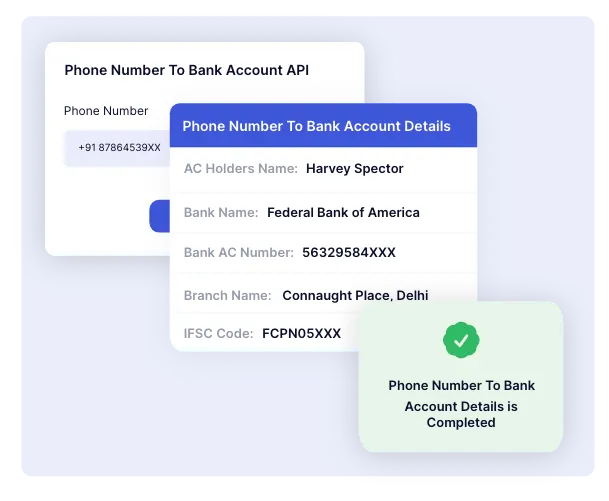

An API, or Application Programming Interface, is a set of rules. It allows software programs to communicate with each other. In money transfers, APIs facilitate transactions. They enable secure data exchange between systems. This ensures money moves from one account to another. APIs help automate processes, reducing manual errors. They streamline operations and improve speed.

Types Of Apis For Money Transfers

There are various types of APIs for money transfers. RESTful APIs are popular. They are simple and easy to use. They work well with web-based applications. SOAP APIs are also used. They are more complex but offer robust security features. Another type is the JSON-RPC API. It is lightweight and efficient. Each type has unique features and benefits. Choosing the right API depends on specific needs. Security, ease of use, and speed are key factors.

Key Players In Api Money Transfers

Leading companies in API money transfers simplify sending funds to bank accounts. They ensure secure and fast transactions. Their technology connects with banks seamlessly, offering reliable financial services worldwide.

Leading Companies

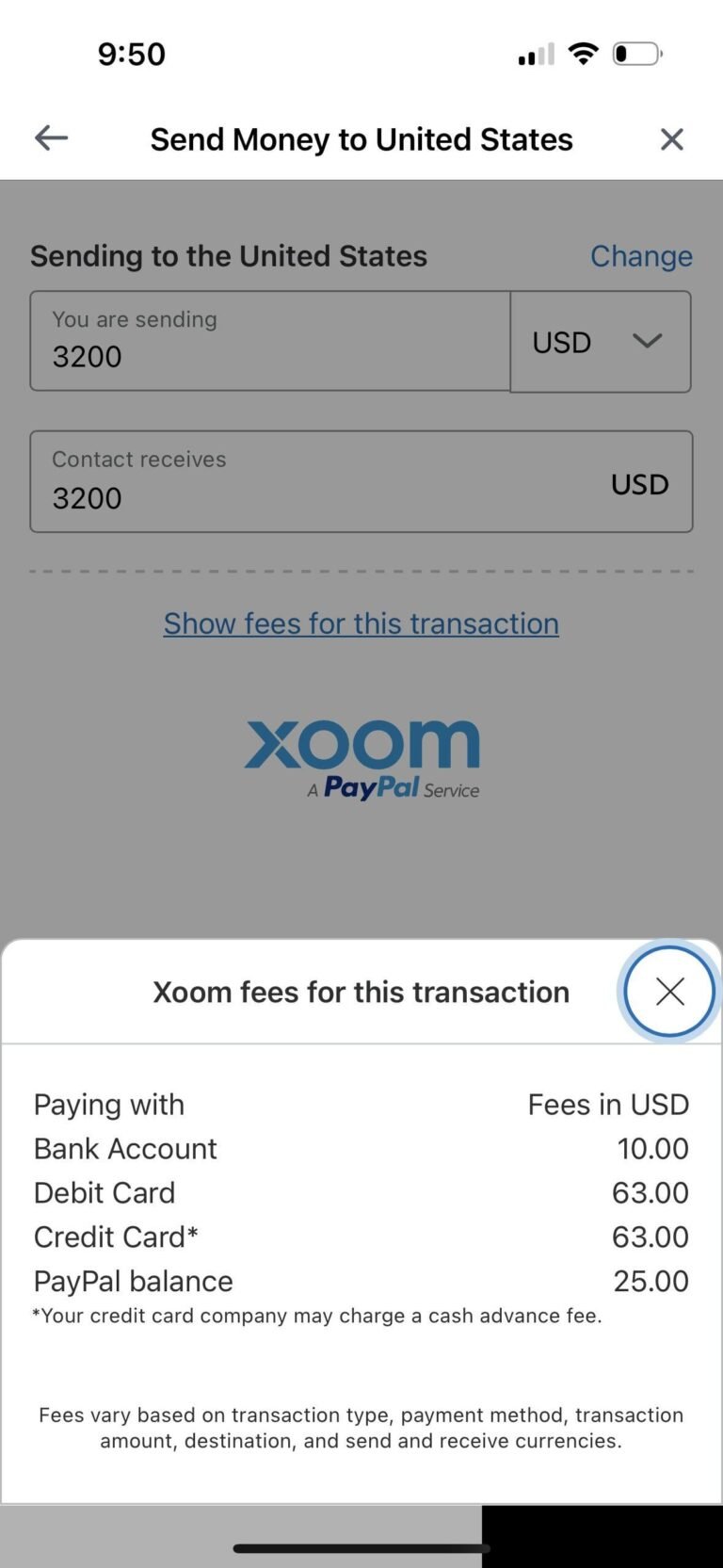

Several giants dominate the landscape of API money transfers. PayPal is one of the most recognized names, known for its user-friendly API that facilitates secure transactions across the globe. They’ve been a staple in e-commerce, empowering businesses to receive payments with ease. Another significant player is Stripe, often favored by developers for its robust API and extensive documentation. Stripe’s flexibility allows businesses to customize their payment processes, ensuring a smooth user experience. Square is also noteworthy, particularly for small businesses. Their API not only handles transactions but also offers features like inventory management and sales tracking. Have you ever wondered how your favorite local café manages its payments so efficiently? Square might just be their secret weapon.Emerging Startups

While industry leaders set the benchmark, emerging startups are continuously pushing the boundaries. TransferWise (now Wise) has gained popularity for offering low-cost international transfers. Its API is designed to be straightforward, reducing the complexity often associated with cross-border payments. Then there’s Plaid, which focuses on data connectivity. Plaid’s API connects your bank account directly to apps, simplifying the way you manage your finances. Imagine checking your account balance right from your budgeting app—Plaid makes this possible. Rapyd is another rising star, offering a global payment network. Their API integrates various payment methods, catering to businesses looking to expand internationally. Are you looking to reach customers in different countries? Rapyd could be your gateway. As you navigate the dynamic world of API money transfers, consider which of these players align with your needs. Whether you’re a developer, business owner, or consumer, understanding these key players can help you make informed decisions and harness the power of APIs effectively.Benefits Of Api Money Transfers

API money transfers simplify sending funds directly to bank accounts. They offer quick transactions, boosting efficiency for businesses and individuals. Secure encryption ensures data safety, providing peace of mind for users.

Transferring money through APIs is fast becoming a popular choice for businesses and individuals alike. APIs, or Application Programming Interfaces, allow for seamless integration between different financial systems. This integration offers numerous benefits that simplify the process of moving money from one place to another. Let’s explore some of the key advantages of API money transfers.Speed And Efficiency

Imagine needing to send money to a friend or pay an invoice. With traditional methods, you might wait days for the transaction to complete. APIs change this by allowing near-instantaneous transfers. This speed ensures that you can manage your finances in real-time, meeting urgent needs without unnecessary delays. Have you ever been frustrated by a slow transaction? API transfers might be the solution you’re looking for.Kosteneffizienz

Sending money often comes with hidden costs. Banks and other financial institutions typically charge fees for wire transfers and international transactions. API money transfers tend to be more cost-effective, as they often have lower fees. This means more of your money goes where you want it to. By choosing API transfers, you can keep more money in your pocket and less in service fees.Verbesserte Sicherheit

Security is a top priority when dealing with financial transactions. APIs offer robust security features that protect your data and funds. Advanced encryption methods ensure that your information remains confidential and safe from unauthorized access. This enhanced security can give you peace of mind, knowing your money is transferred securely. Have you ever worried about the safety of online transactions? APIs can help alleviate those concerns. Using APIs for money transfers can transform how you handle your finances. They offer speed, cost savings, and security that traditional methods may not provide. Why not consider integrating API transfers into your financial routine?

Challenges In Api Money Transfers

API money transfers have become a pivotal part of digital transactions. Yet, they come with their own set of challenges. Navigating these challenges effectively can ensure smoother and safer transactions. Let’s dive into some key issues you might encounter.

Sicherheitsbedenken

Security is the elephant in the room when transferring money via APIs. Imagine if your bank account details were exposed due to a security flaw. Scary, right? This risk is why robust encryption methods are crucial. Developers need to ensure that sensitive information is safeguarded against unauthorized access. Regular security audits can be a lifesaver, revealing vulnerabilities before they become threats.

Einhaltung gesetzlicher Vorschriften

Compliance with financial regulations is not just a buzzword. It’s a necessity. Each region may have different rules governing money transfers. Are you aware of the specific requirements in your area? Ensuring your API adheres to these regulations is crucial. Non-compliance can result in hefty fines or legal action, impacting your business’s reputation and bottom line.

Technical Difficulties

Technical challenges can seem like a minefield. A friend of mine once struggled for weeks trying to integrate an API. The problem? Compatibility issues between software versions. It’s not just about writing code; it’s about ensuring the systems align seamlessly. Are your APIs up to date? Regular updates and thorough testing can prevent these headaches.

Each challenge in API money transfers is a chance to learn and improve. What steps can you take to overcome these hurdles? Addressing these issues head-on can transform potential pitfalls into stepping stones for success. So, are you ready to tackle these challenges head-on?

Steps To Implement Api Money Transfers

Easily transfer money to a bank account using API by following simple steps. First, set up your API credentials. Next, integrate the API into your system. Finally, test the transaction process to ensure accuracy and security.

Implementing API money transfers can seem like a daunting task, but breaking it down into manageable steps makes it achievable. You might be wondering how to begin the process and ensure that everything runs smoothly. Let’s dive into the essential steps to set up an API for transferring money to a bank account, so you can streamline your financial operations effortlessly.Choosing The Right Api Provider

The first step is crucial: selecting the right API provider. This decision can significantly impact your operations. Look for a provider that offers robust security features, comprehensive documentation, and reliable customer support. Consider their transaction fees. High fees can eat into your profits. Compare different providers and choose one that balances cost with quality service. Don’t forget to check reviews. Other users’ experiences can offer valuable insights into the provider’s reliability and performance. What challenges did they face, and how were they resolved?Integration Process

Once you’ve chosen a provider, it’s time to integrate the API into your system. Start by understanding the API documentation. This will guide you through connecting your platform with the provider’s. Next, ensure your system’s compatibility. Some APIs require specific software versions or configurations. Address these requirements early to avoid integration issues later. Are you familiar with coding? If not, consider hiring a developer. They can help you navigate any technical hurdles and ensure seamless integration.Testing And Deployment

Testing is a critical step you should never skip. Conduct thorough tests to ensure every transaction is processed accurately and securely. Use both real and dummy data to simulate various scenarios. Identify and fix bugs. Even a minor error can disrupt operations or compromise security. Testing allows you to catch and resolve issues before they affect users. Finally, deploy the API. Monitor its performance closely, especially during the initial phase. Are transactions being processed as expected? Continuous monitoring helps maintain efficiency and security. Implementing an API for money transfers doesn’t have to be overwhelming. By following these steps, you can facilitate smooth and secure transactions. What challenges have you faced in implementing APIs? Share your experience in the comments below!Future Of Api Money Transfers

The future of API money transfers is poised to transform the way you move your funds across borders and banks. With technology advancing at a breakneck speed, these APIs are becoming more efficient, secure, and user-friendly. As someone who once struggled with clunky, time-consuming bank processes, the idea of seamless, automated transfers is nothing short of revolutionary. Imagine having the ability to transfer money instantly, with just a few clicks, and minimal fees. This is not just a dream anymore; it’s becoming a reality. But what does the future hold for API money transfers, and how will it impact your financial transactions?

Technological Innovations

Technology is at the heart of API money transfers. The introduction of blockchain technology is enhancing security and transparency. Blockchain allows you to track your money from start to finish, reducing the risk of fraud.

AI and machine learning are optimizing transaction processes. These technologies predict potential issues and suggest solutions, ensuring your transfers are smooth and error-free. Think of it as having a personal assistant managing your money transfers.

Mobile integration is another leap forward. APIs now work seamlessly with mobile apps, enabling you to manage transfers from anywhere, anytime. It’s the ultimate convenience, especially when you’re traveling or living abroad.

Market Trends

The demand for instant transfers is skyrocketing. You want speed and efficiency, and companies are racing to meet these expectations. As more people embrace digital banking, API transfers are becoming a standard feature.

Cross-border transactions are increasing. Businesses and individuals are trading globally, and APIs simplify these complex transactions. It’s now easier than ever to send money to different countries without hefty fees.

Regulatory changes are shaping the landscape. Governments are adapting to new technologies, ensuring you have a secure and compliant framework for your transfers. This is crucial for building trust in digital transactions.

So, how will you adapt to these changes? Are you ready to embrace the future of API money transfers and streamline your financial activities? With technology and market trends evolving rapidly, staying informed is key to leveraging these innovations effectively.

Case Studies

Explore how APIs streamline transferring money to bank accounts. These case studies showcase efficient processes and reduced transaction times. Learn how businesses benefit from seamless integration and improved financial operations.

In the world of digital transactions, transferring money to a bank account via an API is transforming the way businesses operate. To truly understand its impact, it’s vital to look at real-world examples. Case studies provide invaluable insights into how companies are implementing these APIs successfully, the challenges they face, and the lessons they learn along the way.Successful Implementations

Companies across various industries are embracing APIs for bank transfers with remarkable success. A small e-commerce startup once struggled with delayed payments and dissatisfied customers. By integrating a money transfer API, they not only streamlined their payment processes but also increased customer satisfaction. Orders were processed faster, and refunds were handled swiftly. Another example is a non-profit organization that utilized an API to manage donations. With automated transactions, they saved time and redirected their focus toward their mission. These stories underline the transformative power of APIs in enhancing efficiency and user experience. Have you considered how a similar approach could benefit your business?Lessons Learned

Implementing a money transfer API is not without its challenges. Some companies initially underestimated the importance of robust security measures. A financial services firm learned this lesson the hard way when they faced data breaches due to inadequate encryption. They quickly revamped their security protocols, reinforcing the need for vigilance. This experience highlighted the critical importance of prioritizing security from the outset. Another lesson came from a retail chain that saw its operations disrupted due to poor API documentation. They realized that investing time in understanding the API thoroughly could prevent costly mistakes. Proper training and knowledge-sharing can preempt such issues. These experiences serve as reminders to prioritize security and invest time in comprehensive understanding. What steps are you taking to avoid similar pitfalls in your API implementation? These case studies shed light on the real-world applications and challenges of using APIs for bank transfers. They demonstrate that with careful planning and execution, APIs can be a game-changer for businesses.Best Practices

Transferring money to a bank account through an API can simplify transactions. To ensure smooth operations, follow best practices. They enhance security and maintain compliance. Each step matters. Let’s explore how to achieve this.

Ensuring Compliance

Compliance with legal standards is crucial. Different regions have different regulations. Understand the rules that apply. Regularly update your knowledge. This keeps your service legal. Documenting every transaction is vital. Keep records for audits and verification. Use automated tools to track compliance. They reduce human error. Ensure your API meets all financial regulations. This builds trust with your users.

Maintaining Security

Security is a top priority in money transfers. Use encryption for data protection. Secure sensitive information from threats. Implement authentication processes. This prevents unauthorized access. Regularly update your security protocols. Cyber threats evolve. Stay ahead with the latest security patches. Conduct regular security audits. Identify and fix vulnerabilities promptly. Train your team on security best practices. Awareness reduces risks significantly.

Häufig gestellte Fragen

How Does Api Transfer Money Work?

API transfers money by connecting financial institutions through secure networks. It facilitates transactions between accounts seamlessly. The API ensures data encryption for safety. Users can initiate transfers via apps or online platforms. This technology enhances transaction speed and reliability.

Is It Safe To Use Apis For Money Transfers?

Yes, using APIs for money transfers is generally safe. They employ advanced encryption protocols to protect data. Financial institutions also implement strict security measures. Users should ensure they’re using trusted platforms. Always verify the API provider’s security credentials.

What Are The Benefits Of Using Money Transfer Apis?

Money transfer APIs offer several benefits. They provide fast, real-time transactions. Users enjoy improved convenience and reduced transaction costs. APIs also enhance the user experience with seamless integration. They support global transactions, expanding financial reach.

Can Businesses Integrate Apis For Bank Transfers?

Yes, businesses can integrate APIs for bank transfers. This streamlines financial operations and improves efficiency. APIs enable automation of payments and reconciliations. They support various currencies and comply with financial regulations. Businesses benefit from improved transaction accuracy.

Abschluss

Transferring money to a bank account via API offers many benefits. It’s fast, secure, and efficient. Businesses can streamline operations, saving time and costs. Users enjoy the convenience of digital transactions. APIs reduce manual errors, enhancing reliability. Developers can integrate them easily.

They offer flexibility to meet unique needs. Transactions become more seamless and automated. This boosts productivity and user satisfaction. As technology evolves, APIs will continue to play a crucial role. Embrace them for smoother financial operations. They simplify the process and improve overall experience.

Explore this option for your financial needs today.