Kann ich eine Kreditkarte mit einem Saldo kündigen?

You might be considering eine Kreditkarte kündigen that still has a balance, but it's essential to grasp what that entails. While it's technically possible, the Auswirkungen auf Ihre Kreditwürdigkeit and overall financial health could be significant. You'll want to think about the consequences, like how it could affect your Kreditauslastungsquote and your credit history length. Before making a decision, it's worth examining your options and what steps you should take to mitigate any potential damage. What might be the best course of action for your situation?

Kreditkartensalden verstehen

To effectively manage your finances, it's vital to understand what a Kreditkartenguthaben is and how it impacts your overall Kreditwürdigkeit. A credit card balance refers to the amount of money you owe to your credit card issuer. This balance can fluctuate based on your Ausgaben, payments, and Zinsbelastungen. Keeping a low balance relative to your credit limit is important, as high balances can lead to increased interest rates and potential financial strain. Monitoring your balance regularly helps guarantee you're not overspending and allows you to pay off debt more efficiently. By understanding your credit card balance, you can make informed decisions that support your financial safety and overall Kreditwürdigkeit.

Auswirkungen auf die Kreditwürdigkeit

Canceling a credit card with a balance can greatly affect your Kreditwürdigkeit, often leading to a decrease in your overall creditworthiness. When you close an account, it can increase your Kreditauslastungsquote, which is the amount of credit you're using compared to your total available credit. A higher ratio can signal to lenders that you may be overextended financially. Additionally, closing an account reduces your Länge der Kredithistorie, which is another factor in your score. This combination can result in a noticeable dip in your credit score. Consequently, it's essential to weigh the potential consequences against your reasons for canceling the card to guarantee you're making a safe and informierte Entscheidung.

Options for Managing Balances

Managing a credit card balance effectively can be a more prudent choice than simply canceling the card, particularly when considering the potential impact on your credit score. One option is to pay more than the minimum payment each month, which reduces interest accrued over time. You can also consider transferring the balance to a card with a lower interest rate, allowing for more manageable payments. Another strategy is to ein Budget erstellen that allocates funds specifically for paying off the card, ensuring you're consistently working toward a zero balance. Additionally, reaching out to your credit card issuer might reveal options for hardship programs or lower interest rates, helping you manage your balance more safely and effectively.

Schritte zum Kündigen einer Karte

Before initiating the cancellation of a credit card, it's essential to understand the implications and follow a systematic approach to guarantee a smooth process. Start by paying off your balance to avoid interest charges. Next, check your credit report to assess any impacts on your credit score. It's also wise to redeem any rewards or benefits tied to the card before cancellation. Finally, make sure you have an alternative payment method ready for future transactions.

- Pay off your balance first

- Überprüfen Sie Ihre Kreditauskunft

- Redeem rewards or benefits

Kommunikation mit Ihrem Aussteller

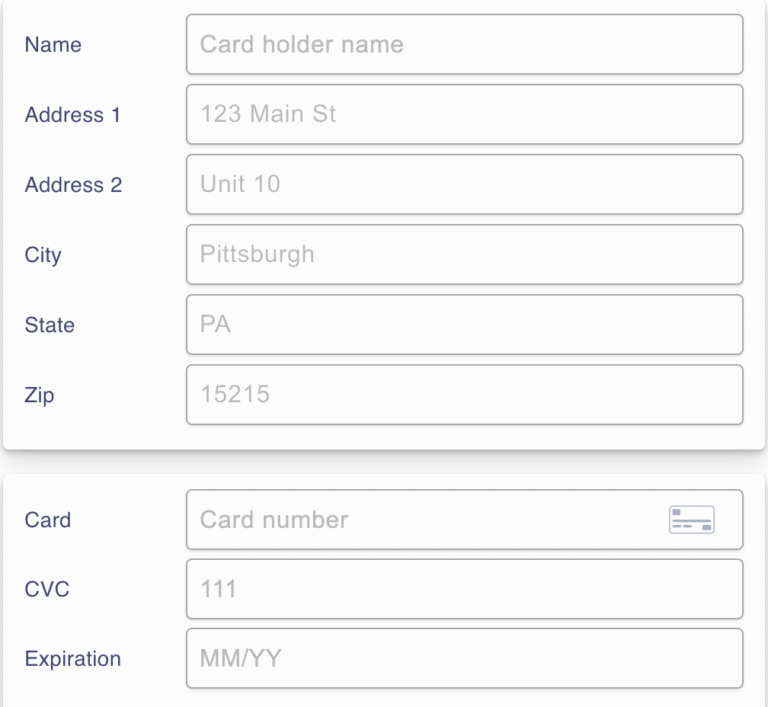

Effective communication with your credit card issuer is essential for ensuring a smooth Stornierungsprozess and addressing any potential concerns regarding your account. Start by contacting Kundendienst, ideally during business hours for quicker responses. Be prepared to Verifizieren Sie Ihre Identität, and have your account details handy. Clearly express your intention to cancel the card, and inquire about any ausstehende Salden, fees, or implications on your Kreditwürdigkeit. Document the conversation, including names and reference numbers, for your records. If you're facing issues or feel uncomfortable, don't hesitate to ask for a supervisor. Maintaining a polite yet firm tone can facilitate a more productive dialogue, ensuring all your questions are answered and your cancellation is processed correctly.

Alternativen zur Stornierung

If you're hesitant to cancel your credit card due to an outstanding balance, there are several alternatives you might consider that can help you manage your account more effectively. Instead of cancellation, you could:

- Negotiate a repayment plan with your issuer to make payments more manageable.

- Übertragen Sie Ihr Guthaben to a card with a lower interest rate to save on interest costs.

- Keep the account open, but reduce your spending and focus on paying down the balance.

Exploring these options can provide you with a path to financial stability while maintaining your credit history and score. It is crucial to choose the approach that aligns best with your financial situation and goals.

Long-Term Financial Considerations

In Anbetracht der langfristige finanzielle Auswirkungen von eine Kreditkarte kündigen with a balance is essential for maintaining a healthy credit profile and achieving your financial goals. When you cancel a card, especially one with a balance, it can negatively impact your Kreditauslastungsquote, which accounts for a significant portion of your credit score. Additionally, closing accounts can shorten your Kreditgeschichte, further affecting your score. If you're concerned about debt, consider paying off the balance before cancellation. This strategy not only safeguards your credit score but also helps you manage your finances more effectively. Always evaluate how the cancellation could influence your creditworthiness in the long run, as it's vital to make informed decisions that support your Finanzielle Stabilität.